As a society, it is imperative that we are constantly prepared for rapid changes in technology. Every fact of our lives has been turned upside down in the past decade due to new advancements, many of which were heightened because of the pandemic. The COVID-19 pandemic forced us to do many things differently, putting importance on social distancing, contactless operations, and virtual interaction. The payment industry was just one of the many that were forced to change during this time, making way for digital money to rise to the top.

As a society, it is imperative that we are constantly prepared for rapid changes in technology. Every fact of our lives has been turned upside down in the past decade due to new advancements, many of which were heightened because of the pandemic. The COVID-19 pandemic forced us to do many things differently, putting importance on social distancing, contactless operations, and virtual interaction. The payment industry was just one of the many that were forced to change during this time, making way for digital money to rise to the top.

PayPal announced a new log-in system ‘Passkeys’ some time

back, and is now rolling it out on its website for Android users. The company

also launched passkey support for Apple devices last year. To access Passkeys

on PayPal’s website, users must have Chrome on Android 9 or above.

Switching your log-in system to Passkeys will not result in your password being removed from PayPal, as it would still be required to log in on unsupported devices.

Despite experiencing a minimal drop in the 3rd quarter of 2021 as compared to the 2nd quarter, PayPal didn’t stop the hustle of improving in every other aspect. From net income to active accounts and completed transactions, the company is growing in all the right directions. As revealed by the sources, around 66 percent of PayPal’s total earnings in the 3rd quarter came from its USA customers.

According to the infographic below, out of the top three payment methods surveyed in four different countries, PayPal is predominantly used in Germany and China i.e., by 51 percent and 76 percent of the total respondents, respectively.

PayPal has redesigned its app to include a variety of new

features, including support for a high-yield savings account and a way to find

coupons in-app. The changes made in the app are quite visible at the first

glance with the revamped homepage.

Previously, PayPal’s app emphasized on displaying the

account balance at the forefront. Now, the homepage displays a quick access to

a number of things, including your balance, your crypto balance, and your

frequent contacts. Other options also appear under different tabs and hubs.

Under the wallet tab, you will see direct deposit and PayPal’s

credit and debit cards. The payments hub includes peer-to-peer payments, bill

pay, charitable donations, and messaging. Similarly, the shopping tab shows coupons

and loyalty programs, while the finance tab includes cryptocurrencies and the

new high-yield savings account.

PayPal had been planning to start its support for the cryptocurrency payments for a few months and finally from today, it has officially announced to allow the users to pay with their Bitcoin, Litecoin, Ethereum or Bitcoin Cash. The online payment is made super easy via the app as a dedicated “Checkout with Crypto” option is available.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22406834/paypal_crypto_screen.png)

In recent years, it's become more important for major corporations to ensure that they're operating to be environmentally sustainable. According to data from the Carbon Majors Database, only 100 of the thousands of companies around the globe are responsible for 71% of the global greenhouse gas emissions dating back to 1998.

The recent announcement by the popular auction site eBay has left people wondering about their money and items up for auction. The company has tweaked the policies for sellers by bringing bank accounts into the picture. Apparently, to sell items on eBay, a user must acquire a bank account, or else their ability to relist or create listings will be restricted by the company. While the company has not announced any specific date for the users to commend with the policies but notifications suggest that said changes should be made by the 14th of February.

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22301302/ebay_warning.jpg)

According to the sources, the company will notify or update the sellers about the bank accounts in phases. However, considering the early update on the site, it is believed that the cycle will come to an end even before 2022. By the end of this year, the company will also be making payments to the major sellers, and this might take a considerable amount of time to get done as eBay is a vast platform where millions of people have signed up to gain or sell something.

Data from the Chinese government has revealed that PayPal

Holding Inc is now the first foreign operator that is fully controlling a

payment platform in the country - it has acquired 30% stake of China’s GoPay.

PayPal has made this stake purchase a year after it bought a

70% stake in GoPay and became the first foreign company licensed to provide

online payment services in China.

By reaching this milestone, PayPal will now be competing with domestic payments giants like Alipay, owned by Alibaba-affiliated Ant Group, and WeChat Pay, owned by Tencent Holdings Ltd. Meanwhile, Beijing is running an anti-monopoly campaign against Alibaba Group Holding Ltd among other internet companies.

A recent PayPal phishing attack is attempting to steal users’

account credentials and other sensitive information that can be used for

identity theft.

The phishing campaign is actively being carried out in the form

of text messages that are pretended to be from PayPal, telling users that their

account has been permanently limited and asking them to click on a link to verify

their account. Usually when a suspicious or fraudulent activity on an account

is detected by PayPal, the account’s status is set to "limited,"

which puts temporary restrictions on activities such as withdrawing, sending,

or receiving money.

By clicking on the link given in the phishing message, users

are taken to a phishing page where they are prompted to log in to their PayPal account.

Logging in on the phishing page would send the users’ PayPal credentials to the

attackers and the phishing page would even try to collect further information

from users, such as their name, date of birth, address, bank details, and more.

The collected information can then provide an opportunity to attackers for identity theft and they can even gain access to other accounts using that information.

The coronavirus pandemic has not only caused massive devastation to many families and individuals, it has also been severely detrimental to the global economy. Many companies and industries are struggling to stay afloat as the world has experienced an unprecedented shift in how people live their lives. Small businesses are especially impacted, with many of them being forced to shut down permanently due to closures and lack of customers. Data from Yelp shows that 60% of business closures due to the pandemic are now permanent.

PayPal announced last month that it would be launching support for cryptocurrency and the functionality has finally rolled out for users in the U.S. This means that PayPal users can now buy, sell, and hold cryptocurrencies from their PayPal account.

The functionality can be seen in the PayPal app by tapping a banner at the top of the main screen that says something about buying cryptocurrency. It will show several cryptocurrency options, including Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

According to a recent official announcement, PayPal is going to start supporting cryptocurrency for the first time, which means that all PayPal account holders will be able to carry out financial activities with popular virtual currencies, including storing, buying, and selling. The service will be available later this year.

This move has definitely made PayPal the topmost significant company in the financial tech sector to adopt support for virtual currencies.

PayPal’s competitor service Square launched support for Bitcoin in 2018, however PayPal is not only going to support Bitcoin, but other virtual currencies like Ethereum, Bitcoin Cash, and Litecoin as well.

Moreover, PayPal has plans of extending the support to its money-making subsidiary Venmo and international markets too, starting from early next year.

With the help of Forbes, this list was compiled of the 100 most valuable brands in the world. The tech industry has dominated the world market for some years and they hold the top 5 places on this list overall. The youngest company on the list, Facebook which was founded in 2004 holds the 5th spot with a staggering brand value of 88.9 billion. That is quite an impressive spot for only being 16 years old. The oldest brand at 221 years old and coming in at the 56th spot is Chase.

Quick Facts:

- Oldest brand on the list is Chase at 221 years old

- Most common industry on the list is technology

- Most valuable brand on the list is Apple $205.5 billion

- The US holds the top 6 spots on this list

- McDonald's rounds out the top ten with $43.8 billion

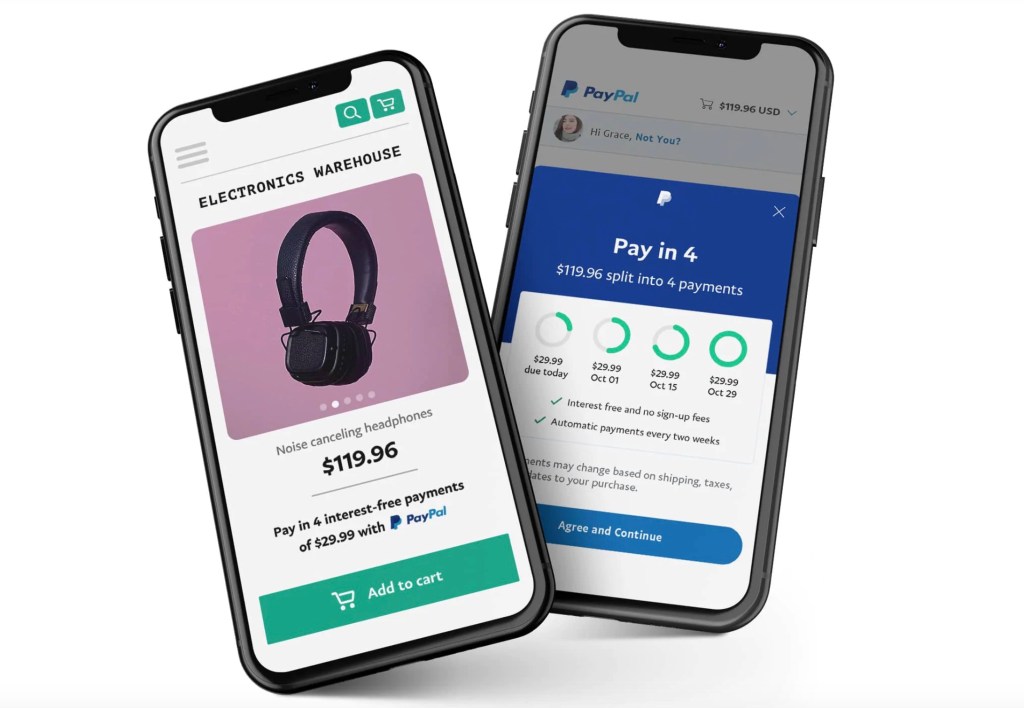

PayPal has introduced a new installment credit option called Pay in 4, that offers customers the ability to pay for purchases interest-free, over four separate payments. The new service is actually an extension of PayPal's existing lineup of its Pay Later solutions.

With the Pay in 4 service, PayPal customers can choose to pay for purchases between $30 and $600 over a period of six weeks. Pay in 4 is included with the merchant's existing PayPal pricing.

Customers in the U.S. can access the short term payment option and can purchase over time without fees or interest. After the first payment, the remaining three are automated. Customers can manage their payments in their PayPal wallet.

PayPal has launched Pay in 4 as a result of a finding that it observed in its Easy Payments service, that at some price points, customers preferred the option to pay over a period of six weeks.

How much you can earn through Freelancing:

How are US freelancing tutors perform:

Freelancing Jobs by opportunity:

Freelancing Platforms controlling

the market:

Share This Infographic On Your Site

Interestingly, more than 60% think that the world is in a technology bubble, with uniformly divided reviews of whether or not it is near to popping.While 57 per cent of founders think that the United States will continue to dominate the technological environment, 39 per cent think that Chinese development will be the global hub for technological innovation by 2028.

Only time will say, with US-China tensions still on the rise, and the worldwide recruitment of technology talent is becoming progressively competitive.The PayPal Mafia is a legendary group of investor-contractors who have a wide impact in Tech since they have been part of PayPal.

The members of this group have not only launched many significant unicorns, including YouTube, SpaceX, LinkedIn and Palantir but also invested in more than 100 startups each. This "giving back," which was planting the seeds of many star businesses in today' s time, had a huge effect on the Silicon Valley Ecosystem.