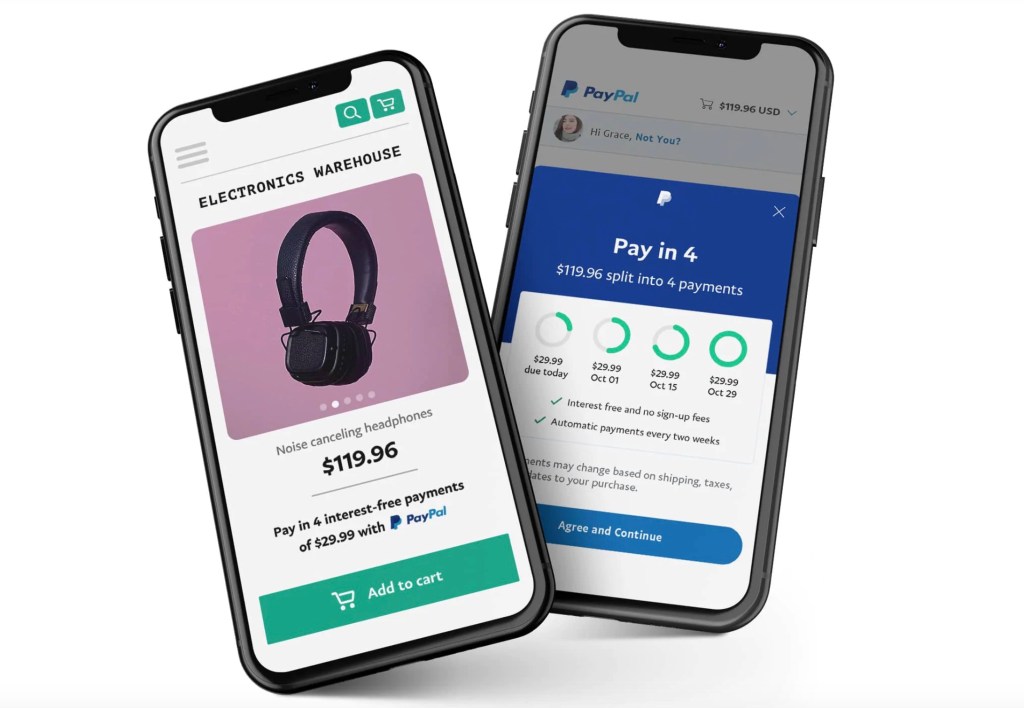

PayPal has introduced a new installment credit option called Pay in 4, that offers customers the ability to pay for purchases interest-free, over four separate payments. The new service is actually an extension of PayPal's existing lineup of its Pay Later solutions.

With the Pay in 4 service, PayPal customers can choose to pay for purchases between $30 and $600 over a period of six weeks. Pay in 4 is included with the merchant's existing PayPal pricing.

Customers in the U.S. can access the short term payment option and can purchase over time without fees or interest. After the first payment, the remaining three are automated. Customers can manage their payments in their PayPal wallet.

PayPal has launched Pay in 4 as a result of a finding that it observed in its Easy Payments service, that at some price points, customers preferred the option to pay over a period of six weeks.

PayPal's Pay in 4 will now become a competitor to fintech services like Klarna, AfterPay, Affirm, and others.

According to PayPal, there will be fees involved if a customer can not pay, and that will vary from state to state, depending on the late fee structure of each state.

The company recognizes the need for ''flexible and responsible'' ways to pay, especially online. Therefore, with the launch of its new service, PayPal aims to enable a responsible and flexible way for customers to shop and simultaneously allow merchants to help drive sales, loyalty, and customer choice.