Inflation is no stranger to citizens of the 21st century, as this year alone, inflation rose 9.1%, surpassing the previous highest increase set in 1981. Almost every essential industry in the United States has been affected by increasing inflation rates, and experts predict that it is not expected to slow down any time soon. The US dollar has depreciated in comparison to most other common forms of currency around the globe, and investors are looking for ways to combat these losses.

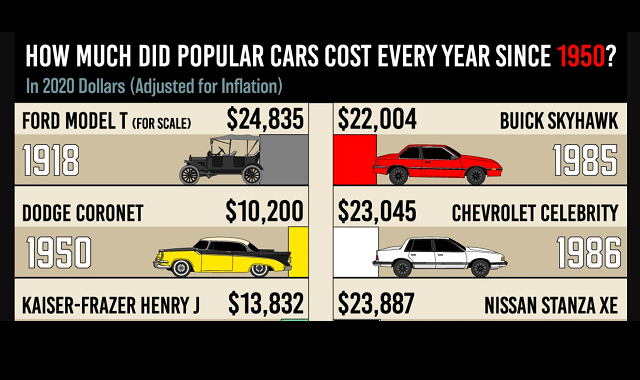

Let's take a look back at some of the most popular consumer cars throughout history. Lucky for us we have this great graphic from the team at Titlemax.com that displays not only the year's most popular car since 1950, but also the price adjusted for today's dollar. Your grandparents may have invested $18k (in today's dollar) in a Plymouth Belvedere which was a popular car in 1954. Maybe if your dad is anything like mine, he had a popular Ford Mustang in 1964 which would cost today around $19,200 dollars. My first car as a teenager was my mom's hand-me-down Honda Accord.

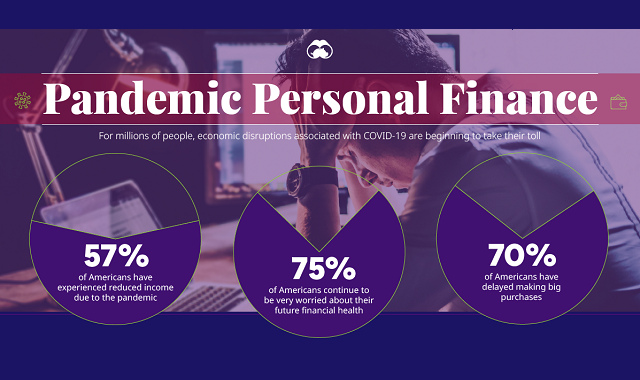

2020 was a rough year for many American’s financially as a direct result of the COVID-19 pandemic. Many people either lost their jobs, were furloughed, or dealt with salary reductions and were forced to re-evaluate their finances and how they approach spending and savings moving forward into 2021.

The folks at Travis Credit Union recently surveyed 2,000 American consumers to learn more about their approach to money -- how they approached spending and savings in 2020, and how they plan to use it in 2021. They wanted to learn how American’s financial habits have changed over the previous year and how their outlook was for the American economy and their finances moving forward into the future. Let us take a deeper dive into their findings from their financial survey.

Whether big or small, outsourcing is for all kinds of businesses. Setting up a business these days can be very expensive. Hence, the various processes involved in running the business can make up even more cost and time. The startup trend is at an all-time high thanks to the way technology has evolved so far.

America is in debt, there is no denying in that. It has been

in the news and a hot topic for many public sectors. Some believe that it is beneficial

for stimulating growth of the country while others debate that excessive government

borrowing can lead to long term negative impacts.

Since 2008, America has had an increase in debt by 200

percent, which has resulted in the total debt of approximately, $27 trillion as

of October 2020. Between 1994 to 2007, the US debt was moderate and stable

which averaged of about 60 percent of GDP overtime. However, the Global

Financial Crisis took its toll and from there, the debt increased up to 95

percent by 2012.

The basic materials that we use on a daily basis, collectively make up the term 'commodities'. Therefore, investing in commodities is essential. But let us talk about metals here, and the various methods of commodity investing. Often on gold and silver investments, volatile returns take place. These volatile returns can either turn out good, or they can even turn out bad.

The market as a whole can become affected by the investments made in metals. The deal is that the higher the prices of metals in the market, the performance of mining companies also gets higher. Hence, the relationship is directly proportional. The rising commodity prices equal to increased earnings increased dividends and of course, there is growth in equity as well.

The coronavirus pandemic has caused a financial ripple

across the globe. From economies shattering due to the lockdown, to big

companies going bankrupt, we all have felt that penny-pinch during the

pandemic. People have literally shut down their businesses amidst the lockdown

because they were going bankrupt. A famous example is Airbnb, who said they

have lost in a few months than they made in six years.

Since the worldwide curfew was imposed seven months ago, 42

percent of US citizens have missed paying their bills while over 39 percent

think that they might have to skip in the future. According to statistics,

about 57 percent of Americans have had some problems with their incomes in the

last seven months whereas, 70 percent have delayed or stopped their spending on

big purchases. This has brought the overall markets down and businesses are

still not doing very well. About 75 percent of people are continuing to be very

worried about their financial status in the future.

Investing is a huge step in terms of a financial aspect. There

are risks attached to it but there are also rewards that reel in an investor. Every

business needs an investor, a sponsor or a dealer to keep the cash flow coming

in for more production. However, they should also fruit some results. Before you

dive into the investment world, you must know that it is not as easy as it sounds.

Banking is an important aspect in one’s life. You need a

bank to keep your finances safe and secure and access your funds whenever you

want to. When you open a new account, you are sure that the bank will provide

the necessary service you require in handling your funds. It is a simple and

secure process.

When we are younger, we look forward to affording the

luxuries of buying candies and toys from the store which is the reason pocket

money makes children so happy. Parents give their children some allowances to give

them a whiff of handling finances. It is a small source of income among the

youngsters. Parents usually ask their kids to do the household chores in exchange

for some money or they just set a weekly/monthly allowance.

Setting up a new business is easier said than done. Even more difficult is making its place and own recognition amongst a wide array of competitors. Planning is even more essential for small businesses that do not have many resources in hand.

Samsung just launched its new digital card, the Samsung Pay Card, in the U.K. The Samsung Pay Card will let users integrate all of their existing bank cards into one single card that will act as their digital wallet.

With the Samsung Pay Card, it will be easier to manage money and additionally, use Samsung Pay more universally.

The card is powered by a London-based fintech, Curve, which means that users will get to have access to features offered by Curve. For instance, users will be able to view their card spending at one place, get instant spend notifications, pay cheaper FX fees than banks usually charge, clear peer-to-peer payments from any linked bank account, and switch payment sources retroactively.

Looking at the impact of climate change on our environment, green bonds have been designated for this very purpose. The money via these bonds is kept solely for investing in projects governing climate and environmental issues. Since 2007, green bonds have been present in the market and big entities such as the World Bank brought them into existence.

These green bonds did stumble in the beginning but as of 2019, green bonds have resulted in a total of 258 billion dollars globally. That's a huge win since, in 2018, it was 51% lesser. There are multiple choices in green bonds which include loans and personal placements too.

Since the population is increasing globally, it also means that the number of retired people will eventually increase. In fact, one in six people will be over the age of 65 by 2050. This will come out as a challenge for countries worldwide, as they will have to assure every retired person gets their rightful pension.

Canada is among the top countries in the world to have its name on the mineral exploration list. Its gold mine districts can be found across Ontario, British Columbia and Quebéc. And even with all those gold district regions already discovered, there is still potential to find gold in the country. But where will Canada's next gold district be? Well, it's most likely to be the Trans-Hudson Corridor, which is spread from Dakota, United States to James Bay, Canada.

The Trans-Hudson Corridor area is one of those regions that have not been previously explored much. The reason why this region is being framed as Canada's next potential gold district is due to the fact that before closing back in 2001, gold and silver were unravelled in millions of ounces in the Homestake Mine. Although the northern portion of the Trans-Hudson Corridor has a few gold mines in operation, yet there are more areas, such as that around the Snow Lake, where gold mineralization is deemed possible.