The team at MovingPlace released a new study pinpointing the American ZIP codes where renters cannot afford to own their own home. In 2025, the average age of first-time home buyers skyrocketed to 40. Just five years ago, the average age was 33. Home prices are rising, and would-be homeowners battle inflation and a tough market. Some locations are more affordable than others, while certain ZIP codes have such high housing costs that ownership is prohibitive for the average renter.

The team at LLC Attorney created the perfect study for people entering the world of real estate investment. The team weighed a comprehensive list of factors to determine the best cities for real estate investment, creating the perfect kickstart for people new to the real estate market. The results show us what the best cities for real estate have in common. These are all growing cities with ample employment opportunities, affordable properties, and decent returns for landlords. While a lot of warm-weather locations took the top spot, we can see exceptions on the list too, suggesting that the presence of big employers may be the strongest factor in driving the real estate market. The team found that the top four best cities for first-time investors were Port St. Lucie, Florida, Cape Coral, Florida, Cleveland, Ohio, and Garland, Texas. Each city is growing, has affordable home prices, and a thriving economy with attractive employers.

The housing market has been competitive for the past several years, leaving many Americans struggling and still dreaming about home ownership. As rents increase, mortgage interest rises, housing stock runs short, and housing becomes more expensive for everyone. The team at Madison Trust Company explores which states are the most and least affordable in terms of housing. They calculated how much of their income residents of each state paid as well as their median monthly costs.

America’s cost-of-living crisis has left millions vulnerable to eviction and foreclosure as rents soar, mortgage rates climb, and affordable housing remains scarce. Mortgage Calculator analyzed the percentage of adults behind on rent or mortgage payments to identify the metro areas at the highest risk. Their findings, displayed on a color-coded map, highlight these key hotspots:

Homelessness in the United States has taken a drastic rise, with rates rivaling the Great Depression era. The COVID-19 pandemic caused economic upheaval, leaving many people in a state of financial emergency, jobless, and unable to afford rising housing costs. The team at Mortgage Calculator emphasized a stark disparity between homelessness rates and the amount of vacant housing in the United States.

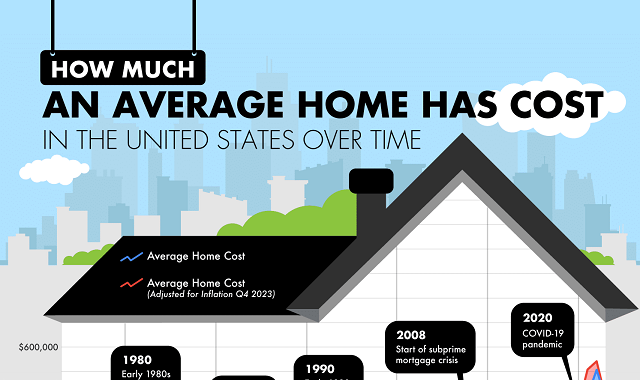

If you’ve bought or sold a home in the past few years, you know that the housing market has been through some massive changes. As you can see from this graphic by Madison Trust Company, we are at an all time high in average American home costs. The graphic shows average costs year by year since 1963. This big picture shows us just how dramatically the housing landscape has changed over the decades.

Do you feel like your money isn’t going as far as it once did? It’s not just you, it actually isn’t. Between inflation and rising costs across the board, things are simply more expensive these days. One area that isn’t exempt from this rise in prices is the real estate market. A house that was sold for $500,000 in 2018 would now be between 20 and 50 percent more expensive in 2023!

Since the beginning of the COVID-19 pandemic, home prices have fluctuated, prompting many people in the United States to relocate to different parts of the country as remote work became more prevalent. Consequently, home prices in various regions of the United States have experienced significant increases or decreases, depending on the location.

Throughout the world, rural properties, farms, and forests are scattered, but who holds the greatest landownership globally? Madison Trust has explored this inquiry and unveiled their findings in a fresh infographic that scrutinizes the world's largest landowners. Their research uncovers that the current reigning landowner worldwide is King Charles III of England, alongside the British Royal Family. Together, they possess a staggering expanse exceeding 6.6 billion acres of land across the globe, constituting a sixth of the planet's surface. Their ownership extends to various territories worldwide, including the United Kingdom and Canada.

While investing in commercial real estate seems like a very attractive investment, be aware of the obstacles and challenges that one will face when choosing to put money into this venture. Bear in mind, this also includes the current financial state of the country as it will factor in the level of risk in making that decision.

Louisville, Kentucky is known to be quite the sporty city. Not only is it home to many well-known and successful teams, but it is also the birthplace of the longest-running sports event in United States history - The Kentucky Derby, dating back to 1875. Switching to basketball, The Kentucky Colonels is considered one of America’s great ABA teams. This team has won the most games in the history of the American Basketball Association.

Some lucky Americans are able to afford second homes, which are often used to spend their vacations or rent out to other people looking to take a trip. Certain locations, particularly along the ocean coastlines and lakeshores, make for popular second homes. The following graphic from Madison Trust maps out where the cities with the most second homes are located.

All eyes are on the housing market as experts expect the volatile market to soon burst sending home prices plummeting. But what about rent? Renters have seen prices skyrocket too since the start of the pandemic with many spending 30 to 40 percent of their monthly income on rent. Which cities in the US are seeing the highest rent prices? Well you don't want to live in the big cities of NYC or LA that's for sure.

Where in the U.S. will you find that the youngest people are buying or selling a home? Check out the results from a study by RealEstateAgents.com, ‘The Average Age and Income of Home Buyers (and Home Sellers) in the 50 Biggest Metro Areas’, to see which of the biggest metropolitan areas in the U.S. have the youngest people buying homes. On the flip side you will also find which of these metro areas have the youngest people selling their homes.

Since the pandemic began, the average home values in the United States have certainly seen surges. This could be attributed to borrowers receiving very low mortgage rates in 2002, which led to more people buying homes, which thus increased the average costs of homes in different cities throughout the United States. From the team at Decorative Ceiling Tiles comes this new infographic that shows you the 50 U.S. cities where typical home prices rose the most since the start of the pandemic.

This handy infographic shows where and when house prices have increased and what the difference is now, compared with each of the past seven decades.

The best way to understand house prices and the way that they have changed over the decades, is by looking at the statistics: facts and figures never lie.

Whether you’re shopping for groceries, filling up your car at the pump, or looking for real estate, there’s no question that inflation is impacting the economy. Each day, ever dollar that you have at your disposal is becoming worth less due to this dynamic. Chances are, you should look for the right investment to keep up with this run up with inflation.

Subscribe to:

Comments (Atom)