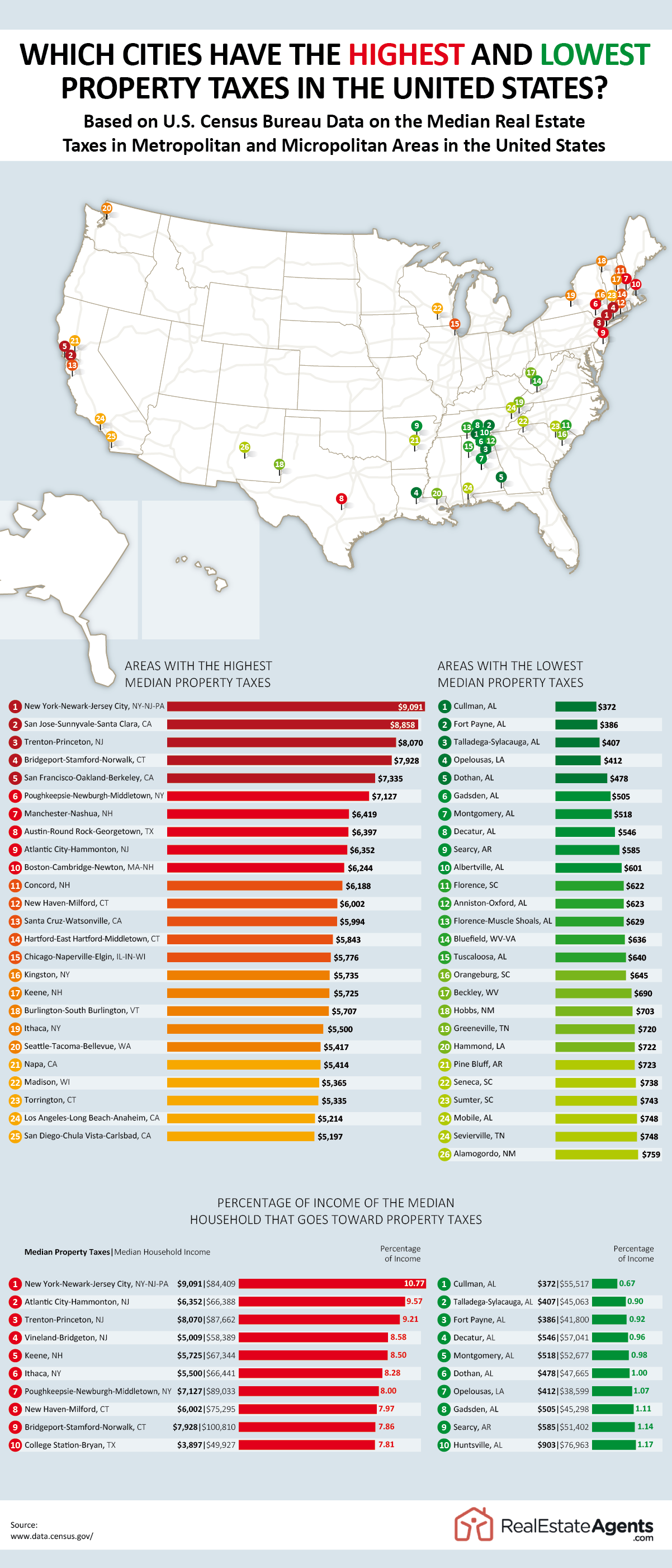

Real estate property taxes are an important aspect of owning a home, and they vary depending on where you live. These taxes are charged by local governments and are typically based on the assessed value of the property. The cities with the highest property taxes are mostly located in the Northeast, while the cities with the lowest property taxes are concentrated in the South. This infographic from the team at RealEstateAgents.com shows which cities have the highest and lowest property taxes in the United States. For example, New York-Newark-Jersey City, NY-NJ-PA has the highest property tax rate, with homeowners paying an average of $9,091 per year, while in Cullman, Alabama, you'll find the lowest property tax rate, with homeowners paying an average of $372 per year. Knowing the property tax rates in your area and how they compare to other cities can help you make informed decisions about buying a home or investing in real estate.

Infographic by: realestateagents