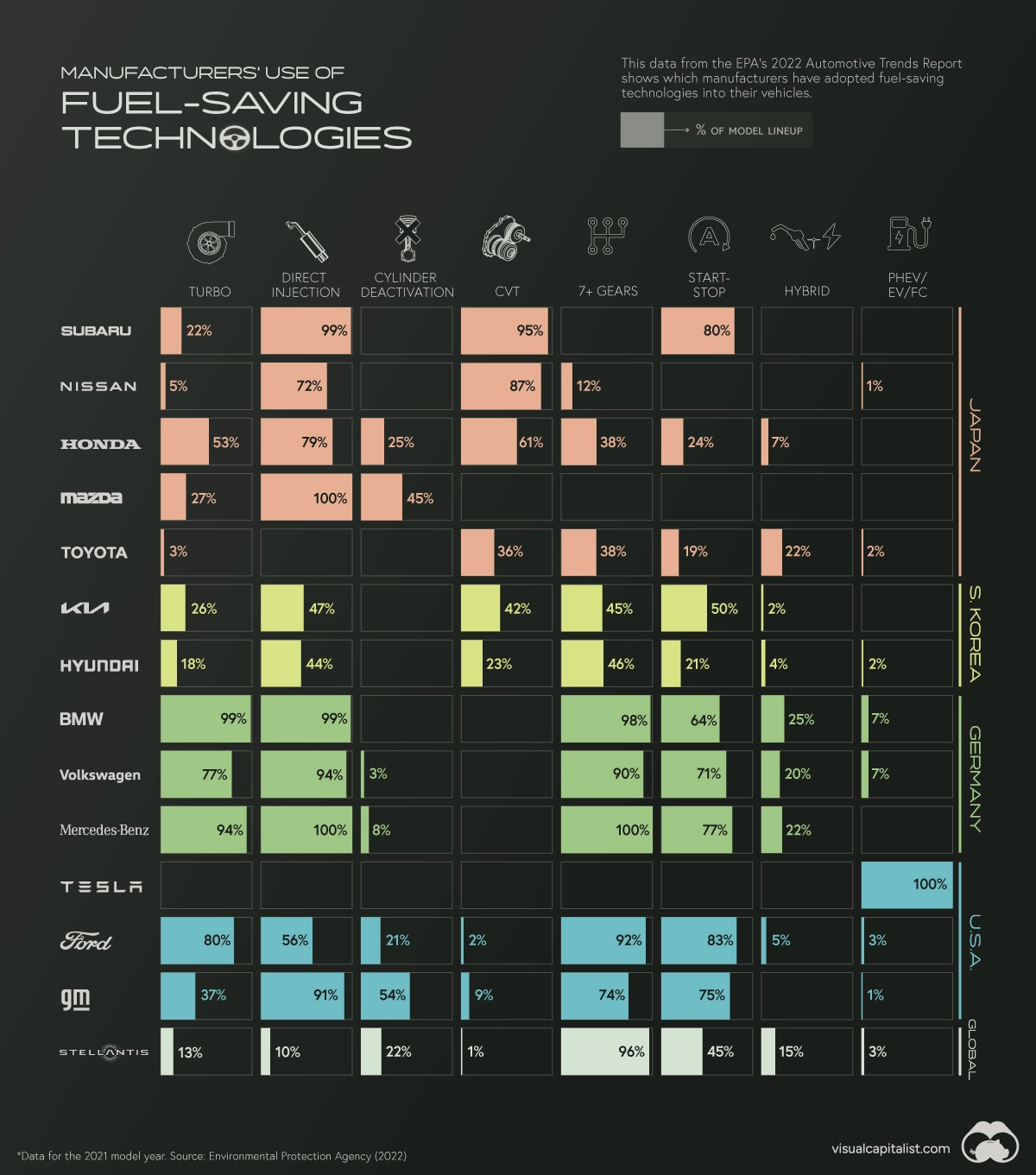

Automakers have invested plenty of time and money into

various fuel-saving technologies, over the past few decades. This includes

improvements such as direct injection, cylinder deactivation, and auto

start-stop features.

It is a difficult task to keep a track of the companies which have adopted these technologies. Luckily, the EPA’s 2022 Automotive Trends Report includes data that shows which automakers have adopted what technologies.

Understanding the Data

The percentages shared in this infographic indicate how 14

major automakers have implemented various fuel-saving technologies into their

lineups. The report did not specify if this data is for North American models

only.

There are several geographical trends hidden within the

dataset. To make it clear, the 14 automakers have been color-coded in the

infographic on the basis of their nationality.

Asian Automakers

Beginning from the top of the graphic, we can see that

Japanese automakers are big supporters of gasoline direct injection (GDI)

engines, as well as continuously variable transmissions (CVT).

When using a GDI engine, fuel is injected directly into the

combustion chamber at high pressure. This method is more accurate than the

traditional method known as port injection, which results in greater fuel

efficiency and lower emissions.

CVT transmissions use pulleys instead of gears to improve

fuel efficiency. CVTs work best when are they are paired with smaller, lower

output engines, which may clarify why Japanese automakers (who have a history

of building smaller cars) have adopted them so widely.

Toyota is listed as having 0% adoption of direct injection,

but this is not true exactly. The automaker uses its D4-S system, which is a

combination of both port and direct fuel injection.

On the other hand, South Korean automakers have a more stable

technology profile, adopting a wider number of technologies, but each to a less

significant degree.

German Automakers

German automakers are well-known for their expertise in

building combustion engines, so their use of turbocharging and direct injection

in nearly every model is of no surprise.

They have also greatly adopted high gear-count transmissions

(7 or more gears), which can not only support better fuel efficiency, but also

faster acceleration. The shortcoming to these transmissions is that they can be

very heavy and complex.

In addition, German automakers make use of the auto

start-stop feature in many of their vehicles, and are tied with Toyota in terms

of hybrid adoption.

American & Other Automakers

Technology profile of Ford and GM is somewhat similar to the

Germans, using turbocharging and direct injection combined with 7+ gear

transmissions.

GM uses turbocharging less often, but stands out with its

high usage of cylinder deactivation technology, at 54% of models. This feature

is referred to by GM as Active Fuel Management (AFM), it works by shutting down

half of the engine’s cylinders during light driving.

GM is acknowledged for its small-block V8 engines, which can

be found in many of the company’s models. Given the high cylinder count of a

V8, AFM is a clever trick for improving fuel efficiency.

Stellantis, which is a merger between Italian-American Fiat

Chrysler and French Peugeot, has not widely adopted many technologies except

for the 7+ gear transmission.

Last on the list is Tesla, which does not use any of the above

mentioned technologies due to it being a pure electric automaker.

Going The Way of the Dinosaur

The technologies presented in this infographic have helped

to bring the average mpg of a new car to record highs in recent years.

Most of these innovations would become obsolete as

automakers slowly phase out gasoline engines. In 2021, six most important

automakers which includes Ford, Mercedes-Benz, and GM assured to phase out the

sale of new gasoline and diesel-powered cars by 2040.

Other automakers such as Porsche believe that the combustion

engine still has a future, pointing to synthetic fuels as a means of

significantly reducing CO2 emissions.

Infographic by: visualcapitalist