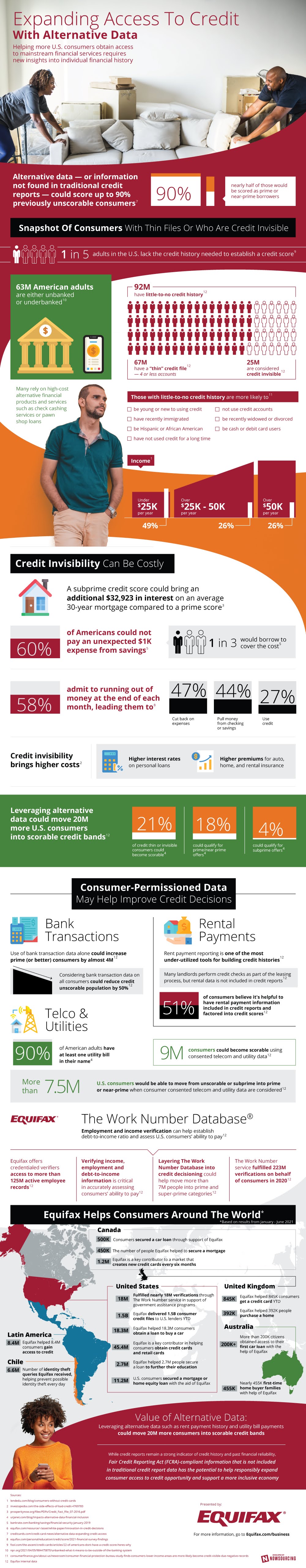

Helping US consumers obtain access to mainstream financial services requires new insights into individual financial history. Current methods of credit reporting leave 1 in 5 American adults in the cold. Credit invisible persons are less able to get personal loans and mortgages than people with sufficient credit history. Insurance premiums are also higher for people who lack a credit score.

People left out of credit access today tend to come from groups historically ignored by financial institutions. Think African Americans, Hispanic Americans, recent immigrants, and people making below median income. Were reporting agencies to leverage alternative forms of data, they could assign a credit score to up to 20 million more Americans. 3 sources of data reporting agencies should look into are bank transactions, rental payments, and utility or telecom bills. All 3 currently require consumer permission, but they can provide accurate insight into the financial history of more people.

Infographic by: equifax